LP 29/2016 CUSTOM FINES FOR CARGO SHORTAGES AND OVERLANDING

Applicable rules with regard to cargo discrepancies in Turkey can be summarised as follows:

1. When performing import formalities, agents apply to the Customs with a declaration form advising the nature, type and quantity of the cargo.

2. While dealing with cargo shortage/over-landing cases, the authorities always take into consideration the percentage of discrepancy between the cargo declaration figures and the cargo outturn figures determined as per the custom’s weighbridge/shore figures.

3. There is no permissible trade allowance for the cargo discharged in pieces/bundles. Vessels discharging cargo in pieces/bundles are obliged to discharge the exact amount of the cargo declared to the authorities or inserted in the relevant cargo documents.

4. The Customs have a tariff rate which determines the trade allowance limit for bulk cargoes(*). The trade allowance for bulk cargoes is generally 3% of the manifested quantity according to Custom’s law article 237.4.

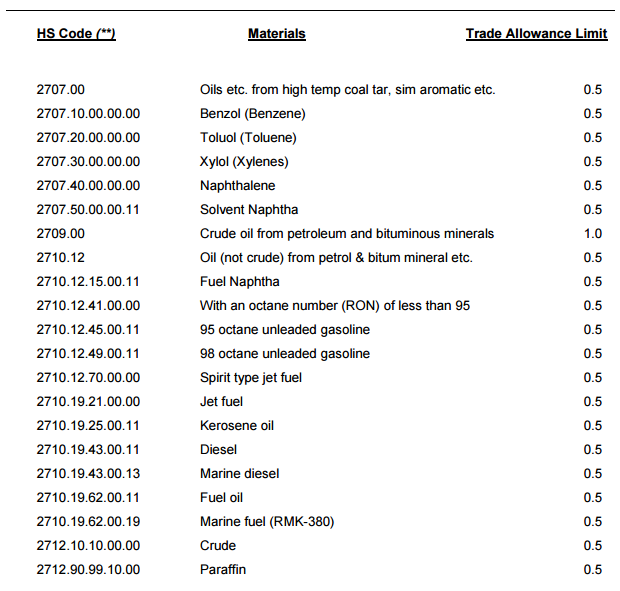

5. However, some cargoes have special limits as per appendix no: 11 of the Customs regulation.

Trade allowance limits for the cargoes with special limits, which we mostly come across, are detailed in the table below:

6. As per the applicable rules, if a shortage or over landing is recorded, the Customs will ask for an explanation from the Owners / their agent to clarify the cause of the subject shortage. In order to provide a reliable explanation, the Customs initially grant three (3) months to the Owners. Further three (3) months will be granted by the Customs if the same will be demanded by the agent.

7. The only way to explain the discrepancy is to obtain a “Correction Manifest” or “Explanation Letter” from the load port. The document should state that the actual quantity loaded on board the vessel was less/more than that initially declared and the actual figure should be corrected in accordance with the cargo outturn figure at the discharging port. The document first needs to be signed by the Chamber of Commerce or the Harbour Master of the loading port if Chamber of Commerce is not available. Thereafter it needs to be legalized by the Turkish Consulate or Embassy.

8. In the event that the Owners failed to obtain the Correction Manifest from the loading port or if the Correction Manifest submitted to the Customs is not accepted by the authorities, then a fine would be imposed in relation to the short/over landed cargo.

9. While calculating the fine amount, the quantity of the short/over-landed cargo exceeding the trade allowance limit will be taken into the consideration. The amount of fine for over-landed cargo is generally equal to the CIF value of the overlanded cargo. The amount of fine for short-landed cargo is generally equal to the import taxes of the short-landed cargo. (Custom fine= CIF value x import regime tax rate)

10. If the Customs decide to impose a fine, the fine that would be imposed is not negotiable. However, if the fine is paid within 30 days from the notification date of the fine, a 25% reduction will be applied as per the procedure of collecting public credits.

11. Alternatively, the party who was imposed with a Customs fine is entitled to apply to the Customs Conciliation Commission within 15 days from the fine notification date. The commission should render their decision within 30 days from the application date. Once the application is made, the Conciliation Commission will invite the applicant to discuss their request and reach an amicable settlement.

Metropole Maritime & Trading Ltd. Co.

(*)Note 1: Definition of “Bulk cargoes” incorporates bulk cargoes in all forms including liquid and gas which are unpacked and loading-unloading operations of these type of cargoes are carried out by mechanical instruments. Packed or countable cargoes are defined as non-bulk cargoes.

(**)Note 2: The Harmonized Commodity Description and Coding System generally referred to as “Harmonized System” or simply “HS” is a multipurpose international product nomenclature developed by World Customs Organization (WCO). It comprises around 5,000 commodity groups; each identified by a six digit code, arranged in a legal and logical structure and is supported by well-defined rules to achieve uniform classification. The system is used by more than 200 countries and economies as a basis for their Customs tariffs and for the collection of international trade statistics. Over 98 % of the merchandise in international trade is classified in terms of the HS.