LP 31/2019 More About War Risks Insurance: Listed Areas, Terms of Cover and Additional Premium

Based on LP 22/2019 War Risks Insurance: Reflecting on Recent Tanker Attacks near the Persian Gulf, this circular is prepared to further talk about practical issues in war risk insurance. Although no other attacks were reported since June 2019, regional tensions seem to have escalated after the UK-Iran tanker dispute. Moreover, the rate of additional premium has been changing, offered by some insurers even on a 24-hour basis. The Club has received many inquiries recently as there are some confusions among the Members.

I. News Chronologies

In a period of only two months in 2019, tensions in the Gulf have been escalated into almost an open conflict. It was reported that:

on July 31, a foreign oil tanker was seized in the Gulf off Iranian coast, allegedly the third foreign ship seized by Iran in the past two weeks;

on July 19, British-flagged oil tanker Stena Impero was impounded by Iran’s Islamic Revolutionary Guard Corps (IRGC) in the Strait of Hormuz, deepening tensions that have flared in the area;

on July 18, IRGC seized an oil tanker in the Strait of Hormuz without disclosing any information about her nationality;

on June 13, two oil tankers – one flagged to Panama and another to the Marshall Islands – were attacked in the Gulf of Oman and both caught fire, leading to fears of wider conflict and soaring premium;

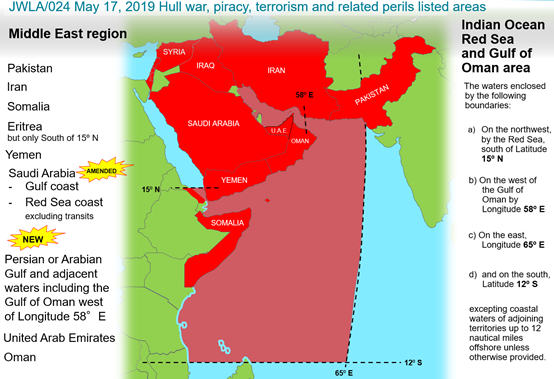

On May 12, four commercial ships – two registered in Saudi Arabia, one in the UAE and another in Norway – were damaged in an explosion near the Port of Fujairah for reasons unknown, prompting the Joint War Committee (JWC) to update Hull War, Piracy, Terrorism and Related Perils Listed Areas (JWLA-024) on May 17, 2019. Oman,

the UAE and the Persian Gulf were included in the update as illustrated in the map below.

Source: Marsh LLC.

II. Areas excluded from war risks cover

Vessels trading around the world are subject to natural, political and many other unknown risks. To free the assured from paying a large amount of annual premium before actually going to areas that are potentially dangerous, most marine insurance policies will include one or more trading warranties that expressly address:

· the areas in which the vessel can operate;

· the type of operation the vessel can engage in (like STS operation);

· the specific voyage the vessel can or cannot perform (like a demolition voyage);

· the type of cargo to be carried on board.

Likewise, trading warranties are set to limit vessels in safe areas in the case of war risks cover. But different from the exclusion on vessels trading in ice, war risks are far more difficult to predict and areas with perceived enhanced risks during the term of a certain contract are constantly changing. Therefore, a clause that allows insurers to determine the additional premium (AP) areas at any given point is incorporated for risk containment purposes.

However, there is no single rule for the definition of AP areas as insurers perceive risks in different ways. To make a contract, especially a fixed-term one valid and executable, referring to JWC publications of the London insurance market has become a universally accepted practice.

The latest version JWC Hull War, Piracy, Terrorism and Related Perils Listed Areas (JWLA-024) was published on May 17th 2019 after the Fujairah attack to include Oman, the UAE and the Persian or Arabian Gulf and adjacent waters including the Gulf of Oman west of Longitude 58°E (see the map below).

Source: Marsh LLC.

Note:

1. Named Countries shall include their coastal waters up to 12 nautical miles offshore, unless specifically varied.

2. Named Ports shall include all facilities/terminals within areas controlled by the relevant port authorities including offshore terminals/facilities, and all waters within 12 nautical miles of such.

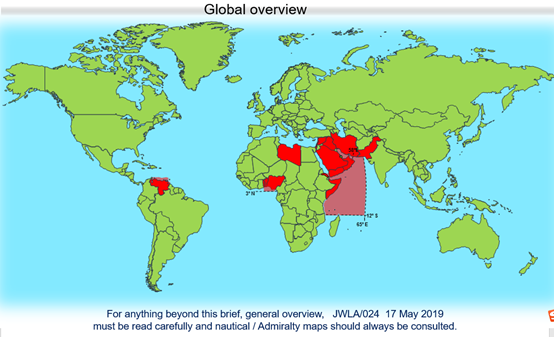

Globally, listed areas are found mainly in two regions – the Gulf of Guinea where piracy prevails and the Persian Gulf where regional situation remains unstable with unforeseeable risks, the latter exerting greater influence to the shipping community.

III. Held cover and additional premium rates

Held cover clauses are not uncommon in marine insurance contracts. In war risks insurance, both trading area warranties and limits are included in the policy to restrict the areas in which vessels are allowed to travel. To protect the assured from risks arising from entering listed areas in breach of the warranty, held cover is arranged to extend the existing insurance to provisionally cover the listed areas or IWL. Subject to agreement on the term and conditions, an AP will be chargeable by the underwriter.

There is no fixed AP standard available in the market. War risks insurers will determine the additional rates and terms of cover after evaluating its own capability and the situation in the listed areas with reference to the JWC standard. And naturally, the AP rates may differ from one insurer to another based on the evaluation.

Often in a charter party, the charterer is held liable to reimburse the extra premium to the shipowner for voyages in the listed areas. However, disputes arise when a huge amount of premium is levied, and here are some tips for the Members:

· Ask if the charterer get his offer from a broker or directly from an insurer whose credibility should then be examined;

· Check the underwriting conditions in the two offers and see if a B&T clause is included;

· Check whether the two offers are made at the same time;

· Reach out to our H&M team if necessary.

Given the soaring premium for voyages in the Persian Gulf and disputes may arise out of it, Members are strongly advised to exert caution when negotiating with charterers.

IV. Terms of cover and procedures

1. Prior notice to the underwriter

Prior notice of entry is required in order that held cover may be arranged. The assured is obliged to inform the underwriter of the voyage plan (information including the destination and ETA) as soon as such voyage is scheduled, ideally 48 hours in advance.

2. Seven days’ notice

The 7-day notice of cancellation is often attached as a special clause to the war risks insurance contract, suggesting that both the insurer and the assured are eligible to issue a notice 7 days in advance to cancel the agreed insurance. Such notices, in practice, are frequently issued by the underwriter, not the assured.

It used to be 14-day notice of cancellation in earlier war risks insurance contracts and it was shortened probably for reasons including:

· In a time when telecommunication is underdeveloped, it takes some time for the notice to be delivered.

· The London market was traditionally dominated by brokers and forwarding such notices to the assured may take some more time.

· Enough time was left for vessels to escape areas that are suddenly stricken by war.

· Enough time was left for the assured to react upon receiving the notice.

The shift from 14 days to 7 days can be traced back to 1960s when the Indo-Pakistani War suddenly broke out. The London market issued a cancellation notice immediately after the war, including India and Pakistan to AP areas with a relatively high premium. However, the war ended before the notice ever comes into effect and the insurer still had to indemnify the assured for their loss within the 14 days.

3. Held covered period

Unlike the 7-day notice of cancellation as stated in the termination clause of ITC-Hull 1/10/83, covering the risks of entering AP areas on a weekly basis is not a law but a common practice. It allows the underwriter to maneuver in accordance with the volatile situations. In practice, even JWC updates the listed area quite often, and insurers may provide additional cover on a 10-day, 14-day or 20-day term if regional tensions seem to have eased. Members may choose the best possible solution after giving full consideration to the duration of time in the AP area and unexpected circumstances where cargoes cannot be discharged in time if calling at ports in AP areas.

4. 48-hour validity

Controversies have been reported recently over the 48-hour validity – is the AP offer valid only for 48 hours or does the covered vessel have to enter the AP area within 48 hours for the insurance to be valid?

The answer is yes to both. Although it’s not specifically stipulated in any applicable laws, war risks insurers have generally adopted the practice where the assured need to accept the offer and have the covered vessel entered the agreed area within 48 hours (24 hours in some cases). The shrink of time may pose some challenges to shipowners, but such demand is fair and reasonable considering the unpredictability of war risks and development of modern telecommunication technologies.

The assured are recommended to keep close contact with the underwriter to double check the term of cover and provide prompt advice on the whereabouts of the covered vessel. The insurer will normally reserve its right to modify the charge upon significant changes in the situation, and its offer will be expired if the 24/48-hour period is due.

V. CPI war risks insurance

In response to market demand, the Club offers single-voyage insurance for vessels trading in listed areas. As it’s previously mentioned, different insurers may have different judgement over the risks and the assured is free to arrange held cover after comparing quotations on the market. Shipowners are welcomed to contact us if such demands need to be accommodated and the Club will render services accordingly.

For further information, please contact our H&M team.