LP 22/2019 War Risks Insurance: Reflecting on Recent Tanker Attacks near the Persian Gulf

On May 12th 2019, four commercial ships were damaged off Fujairah, UAE. Later, on June 13th, two more oil tankers were reportedly attacked east of Strait of Hormuz, leading to escalated tensions in the area and increasing attention from war risks insurers around the world.

The nature or motive of the attack and the weapons deployed are not yet identified. However, noting the fact that the media has described the explosion as “an assault” not “an incident”, it’s better not to underrate its impact.

War risks covers:

In practice, claims arising from hull war and strikes are usually covered in H&M insurance policies on an excess basis, as denoted in additional clauses by domestic insurers. War risks cover, given its nature, is often provided separately throughout the world market, pursuant to which the Club has been issuing separate certificates for war risks covered members.

- Premium

Fixed premiums during the term of contract (entered vessels trading in low-risk regions around the world) and additional premiums during certain periods (in high-risk areas) add up to the whole. It has been a universal practice to refer to the London insurance market’s Joint War Committee (JWC) publication for areas where there is a perceived enhanced risk and an additional premium is required.

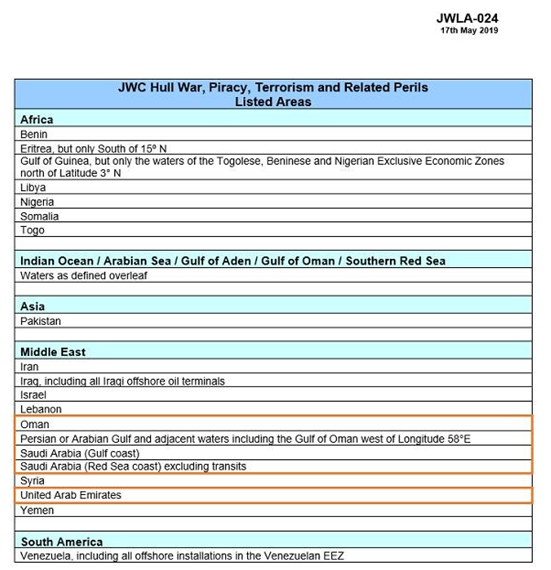

- Additional Premium Areas (Listed Areas)

The latest version JWC Hull War, Piracy, Terrorism and Related Perils Listed Areas was published on May 17th 2019 after the Fujairah attack to include Oman, the UAE and the Persian or Arabian Gulf and adjacent waters including the Gulf of Oman west of Longitude 58°E (JWLA-024). The Club has also issued Circular H&M 02/2019 on May 22th to inform its members of the update.

- Advice for vessels heading towards the listed areas

- Inform the insurer prior to the voyage

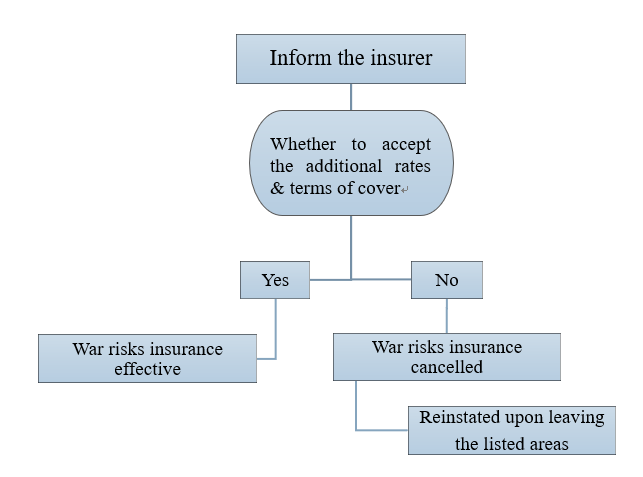

For vessels heading towards the listed areas, members are advised to arrange additional cover which will only enter into force with written confirmation from the insurer on the premium and the amended terms of cover.

Members that choose otherwise can inform the Club of cancelling the insurance. War risks cover will be terminated upon entry to the listed areas and automatically reinstated after leaving the area. However, the Club strongly advises against such practice as shipowners may be subject to zero indemnity for losses and liabilities if the vessel encounters any risk, especially risks specified in the insurance policy. Moreover, in the event of any breach of the ship mortgage clauses, claims from the mortgage holder may be filed.

- Keep in mind the 48/7 principle

Both the insurer and the insured are eligible to issue a 7-day notice cancelling the war risks insurance. The insurer will then take 48 hours to assess regional situations before offering the additional rate and cover policies which will be expired if the insured vessel is not within the agreed area when the 48-hour period is due. The insured will then have to notify the insurer again for the previous confirmation upon approaching the area.

The 7-day notice of cancellation is often attached as a special clause to the war risks insurance contract, and the risks arising from entering the listed areas are often covered on a weekly basis.

- About the additional rates

The Club and other war risks insurers will determine the additional rates and terms of cover after evaluating its own capability and the situation in the listed areas, with reference to the JWC standard. The rates may differ from one insurer to another based on different evaluation.

- Advice for vessels already in the listed areas

Members are advised to reach out to local correspondents upon deciding on the operation period and leave the area once the operation is done. Meanwhile, the crew should be informed of the potential risks and be assured. Also, a designated person should be appointed to follow closely on local situations, especially on reactions of different parties to the attack, if there’s any. Contact the Club for any updates on the vessel and confirm availability for additional insurance.

Once again, for vessels entering the territorial waters of the listed areas, members should arrange additional insurance, the war risks cover will otherwise be automatically terminated.

Advice to members

With regard to the possibility of military confrontations near the Strait of Hormuz and Persian Gulf, the members are suggested to take the following precautions when planning to operate in the region and be vigilant for operations already there:

- Continue to follow the registration and reporting procedures described in chart Q6099 and BMP 5;

- Report Security incidents including suspicious behaviour to UK MTO, MSCHOA and CMF. Details are found in BMP 5;

- Increase vigilance of ship’s crew e.g. by stepping up on lookouts and security patrols, keep VHF radio watch and maintain communication with port authorities;

- When operating in the listed areas, implement security measures equivalent to ISPS Security Level 2;

- Consider improving the watertight integrity of the hull by closing selected doors and hatches;

- Consider ensuring that crew sleeping areas are located above the waterline;

- Consider the wide range of additional self-protection measures as described in ATP-02.1 Naval Cooperation and Guidance for Shipping, which can be found on the joint industry security website;

- Maintain close dialogue with insurance providers.

Reference:

Assessment and advice from BIMCO regarding the oil tanker attack at just east of the Strait of Hormuz

For more information, please contact Managers of the Association.