LP 03/2026 CPI Review on Shipping Safety Risks 2025

Amidst the challenges of global warming, the shipping industry finds itself deeply entangled in a complex predicament characterized by inter-state strategic competition, fuel transition, and geopolitical risks. The transition toward green and intelligent operations has emerged as the critical pathway to navigate current challenges toward a sustainable future.

On October 17, 2025, the IMO MEPC ES decided that adoption of the Net-Zero Framework was adjourned for a year to 2026. This means that the regulation originally expected to enter into force in 2028 will be enforceable at least in 2029.

Although the negotiations on NZF have been temporarily put on hold, the pace of transformation towards green and intelligent within the shipping industry has not slowed down. DNV pointed out in its Maritime Forecast to 2050 (2025 Edition) that increasingly stringent regulations, technological innovations, and accelerating global commitments are jointly driving the industry into potentially a most decisive decade.

Maritime safety now presents a multifaceted landscape where traditional risks persist alongside emerging challenges. Geopolitical considerations have eclipsed operational concerns as the primary source of industry uncertainty, while cybersecurity and energy transition introduce novel risk dimensions. In this historic transformation, only those stakeholders capable of navigating uncertainty and establishing clear technical benchmarks will achieve sustainable progress.

I. Industry Insight

01. ICS Maritime Barometer Report 2024-2025

In June 2025, the International Chamber of Shipping (ICS) published Maritime Barometer Report 2024-2025 with the theme “Building stability in a volatile world”. The ICS Chairman Emanuele Grimaldi emphasized that shipping operates in a rapidly evolving world where political unpredictability has become the new normal. This geopolitical instability is making and reshaping the business operating environments, adding caution and uncertainty to commercial decisions, in addition to rewriting long-standing trade relationships and trade routes.

02. UNCTAD Review of Maritime Transport 2025

In September 2025, the UN Trade and Development (UNCTAD) released the Review of Maritime Transport 2025: Staying the course in turbulent waters. The report warned that global shipping is entering a period of fragile growth, rising costs and mounting uncertainty. “The transitions ahead – to zero carbon, to digital systems, to new trade routes – must be just transitions,” said UNCTAD Secretary-General Rebeca Grynspan. “They must empower, not exclude. They must build resilience, not deepen vulnerability.”

03. IUMI “energy transition not just a green story but a risk story”

In September 2025, the International Union of Marine Insurance (IUMI) held its annual conference in Singapore. Ilias P. Tsakiris, Chair of the Ocean Hull Committee, pointed out that the risk environment is intensifying, driven by an ageing fleet, more severe losses, geopolitical shocks and the operational complexity of the energy transition.

04. Cefor special focus on fires and claims costs

The Nordic Association of Marine Insurers (Cefor) released the 2025 mid-year hull report which shows that fires dominate 2025 major claims. As of June 30, 2025, 4 claims with losses exceeding 20 million US dollars (all fires) had been reported, far exceeding the average level of the past decade. At the same time, from 2015 to 2021, the machinery damage claims costs per ship stabilized at 20,000 US dollars per year and has increased since then. From 2023 to 2025, machinery damage and fire claims jumped by 16% compared with 2022.

05. DNV Maritime Safety Trends 2014-2024: Preparing for future risks

The report shows that the number of maritime incidents increased by 42% between 2018 and 2024, while the number of vessels in the global fleet only increased by 10% during the same period. The uptick in casualty was primarily driven by machinery damage/failure and an ageing fleet.

06. Allianz Commercial Safety and Shipping Review 2025

The report shows that although data suggests the number of total losses is now down to a record low, factors such as geopolitical risks, the expansion of the shadow fleet, and China-US trade conflicts are bringing unprecedented complex challenges to the global shipping industry.

II. Trends and Outlook

The global shipping industry faces dual pressures from decarbonization imperatives and geopolitical turbulence. Regulatory frameworks including the IMO NZF and FuelEU Maritime mandate rapid transformation toward green and intelligent operations. While this transition promises long-term safety benefits, it introduces multiple risks including technical adaptation, regulatory fragmentation, and operational evolution.

While green and intelligent shipping improves energy efficiency, it also brings fundamental changes to maritime safety concerns. For one thing, shipping companies are challenged by operational risks such as professional skill gaps brought by evolving technologies. For another, geopolitical turmoil and policy changes are also reshaping landscape of the shipping industry.

The process of moving towards green is essentially a safety revolution beyond the technical level. The shipping industry must take the initiative of strategic transformation and navigate through changes by adhering to systematic thinking.

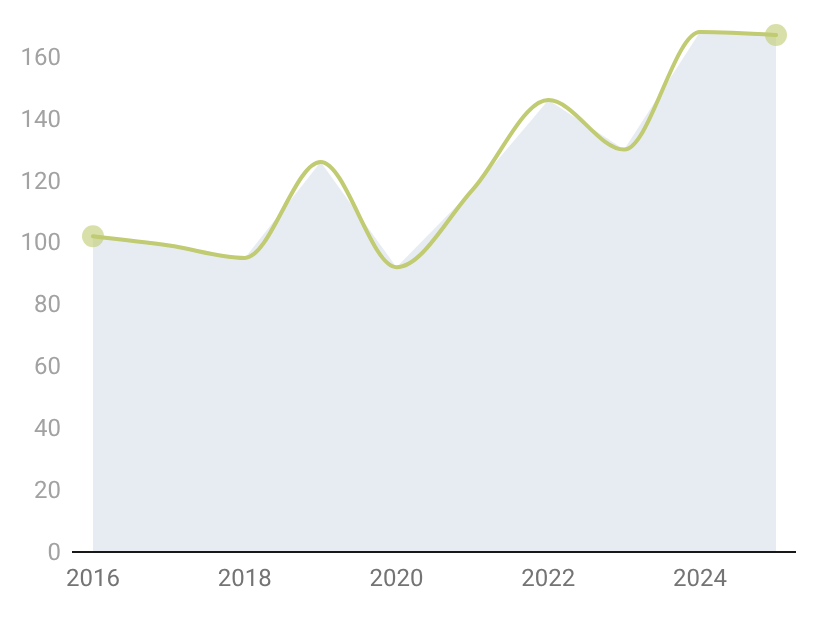

III. Statistics 2016-2025

The number of reported incidents has declined in 2025 globally, but challenges remain with major risks persist and emerging risks become prominent.

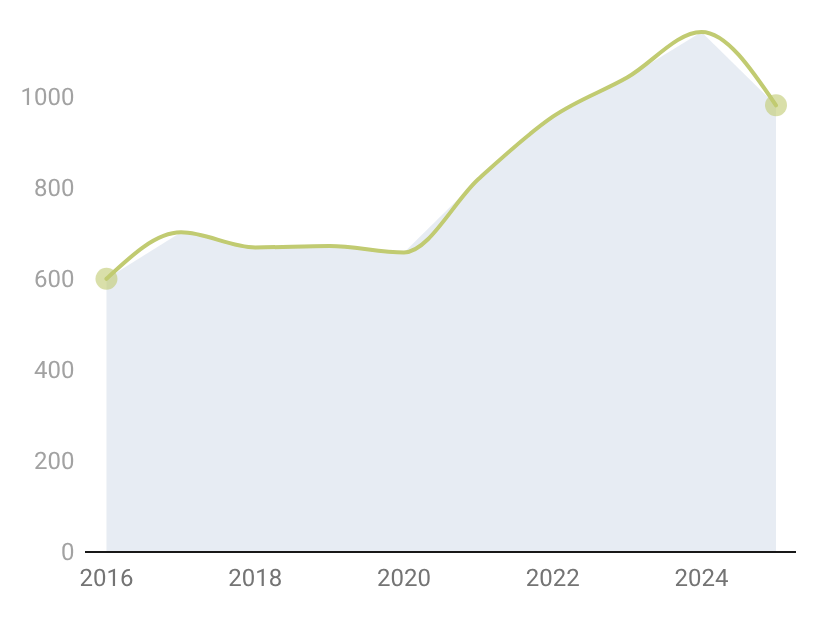

01. Machinery Damage/ Failure

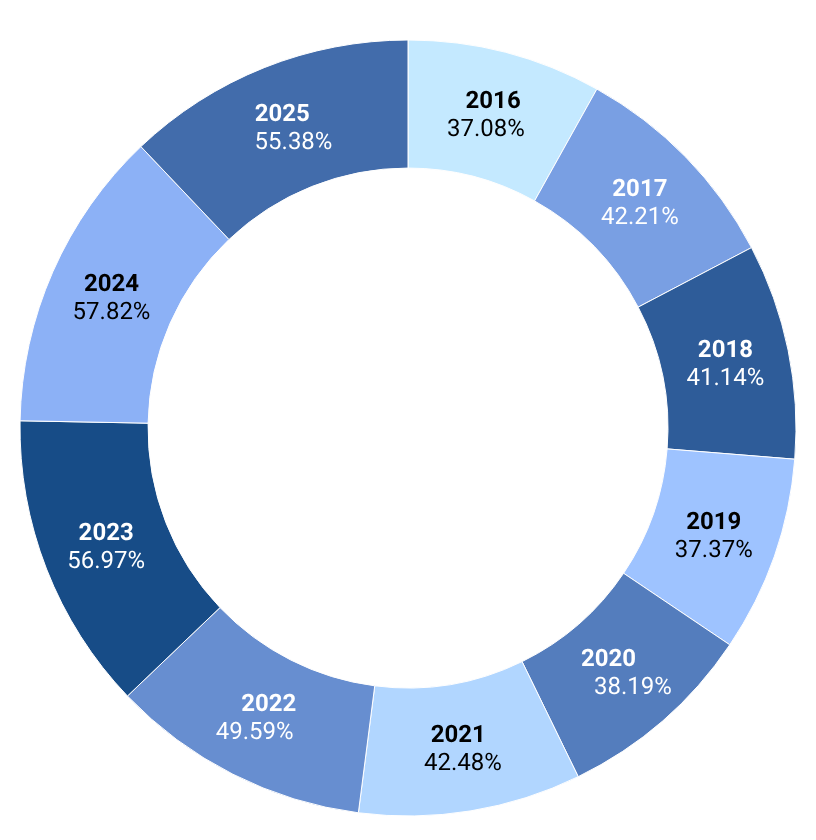

Statistics show that machinery damage/failure has been the main cause of shipping incidents in all years. In 2025, 51% of machinery damage incidents came from ships over 20 years old, and the number in 2024 was 48%.

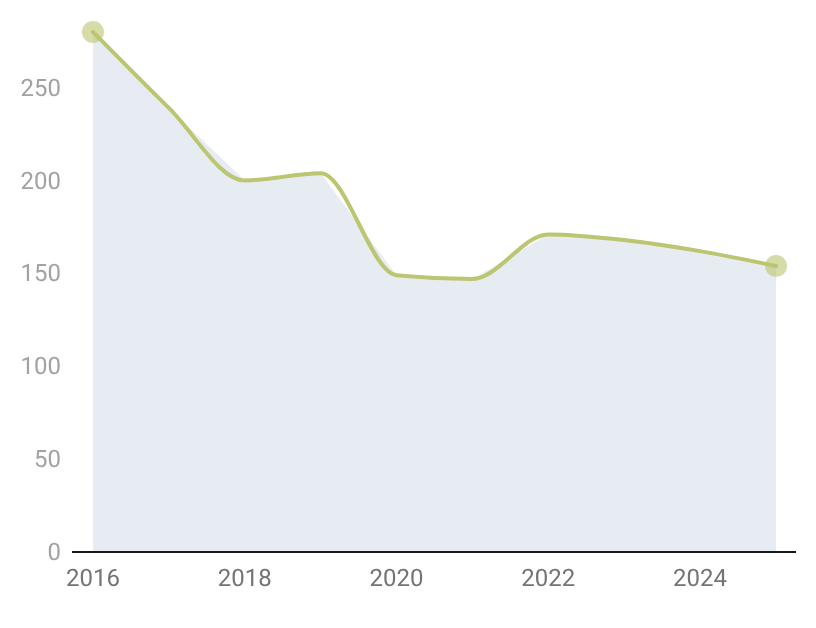

02. Collisions and Contact

According to Lloyd’s List Intelligence data, a clear correlation has emerged between an ageing global fleet and an uptick in safety incidents over the past two years. The mechanical aging and structural corrosion of old ships are the main causes of collisions and groundings.

Collision Contact

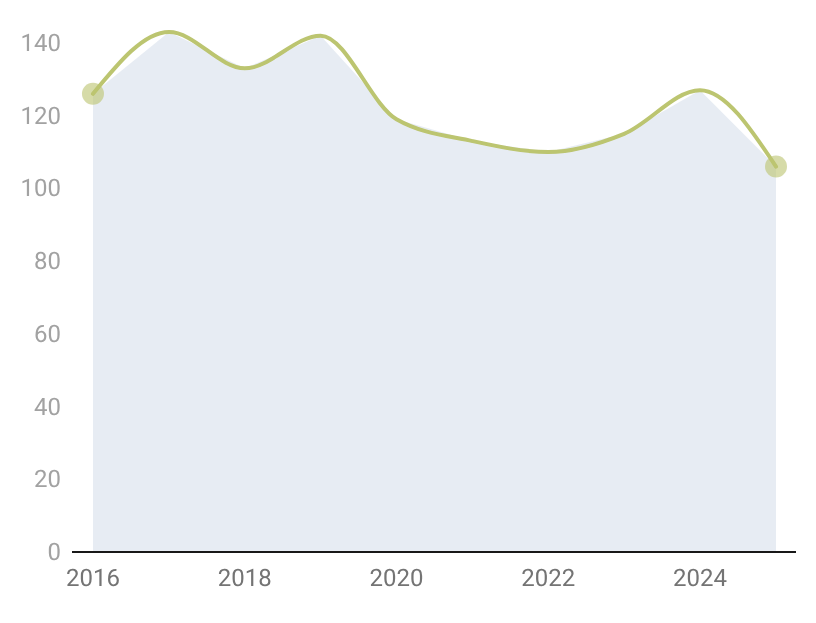

03. Fire Risks

Fires remain the top concern on large container ships due to the size of these ships and the complexities involved in firefighting and salvage. The volume of transporting goods such as lithium batteries and new energy vehicles by sea has surged, bringing new fire hazards.

IV. Safety Challenges

01. Geopolitical Risks and Shadow Fleet

Geopolitical risks are recognized as the foremost threat to the shipping industry over the coming two years. The shadow fleet resulting from the Russia-Ukraine conflict continues to expand, comprising predominantly aging vessels that circumvent sanctions. This substantially elevates oil spill concerns with uncertainties in regulation and insurance.

02. Fire Remains a Major Threat

Mis-declared cargo remains the chief contributing cause to container ship fires, despite growing awareness of the issue among shipowners according to Allianz Commercial analysis. The trend toward larger container vessels further complicates firefighting efforts, resulting in significant environmental and economic impacts and may generate substantial losses due to cargo damage and delays. Growing market demand for lithium-ion batteries, including those used in electric vehicles, introduces new risks as well.

03. Ageing Fleet and Machinery Failures

Machinery damage/failure has traditionally accounted for the largest portion of incidents. However, its share has increased significantly over the course of the past decade. The DNV Maritime Safety Trends 2014-2024 pointed out that the ageing fleet and machinery damage/failure bring higher operational risks for old ships in terms of collisions, contact, groundings, and fires.

04. Cargo Claims

According to IUMI’s 2025 analysis of the global marine insurance market, in 2024 there were 583 cargo claim records with a threshold of USD 250,000 per claim. A steady improvement in overall claims experience can be observed over the past three years. Not only has the number of claims declined by 19% compared to 2023, but the total claims amount has also fallen by 21%, from USD 856 million to 677 million in 2024.

05. Digital Transformation and Cybersecurity

The increasing digitalization and intelligent transformation are converting vessels into complex networked systems. Recent years have witnessed frequent cyber-attacks targeting shipping infrastructure, with escalation in both sophistication and level of threats. Cyber risks, once predominantly terrestrial, now extend across maritime domains, presenting significant challenges to vessels, crews, and the marine environment.

V. Anchored in Uncertainty

The global shipping industry is experiencing a historical turning point. With decarbonization schemes like the IMO NZF, EU ETS and FuelEU Maritime all in place, companies are under unprecedented pressure of compliance.

The route to net-zero emissions by 2050 will surely be paved by the global regulatory framework, regional policy trials, and commercial efforts from leading enterprises. The future of the shipping industry does not lie in seeking a perfect single solution, but in building a system that is sophisticated, resilient, and constantly evolving. In the turbulent sea of changes, only those with insight into the essence of market development can calibrate their course and move forward steadily.

VI. Closure

The green and intelligent transformation of the shipping industry is not only a technical update, but also a process of reconstructing capabilities and reshaping values. The future shipping industry will be an organic whole: advanced fuel technology to guard the ecological bottom line of the planet, intelligent systems to improve the operational efficiency of global logistics, and what lie at the core of the system are the people who have both professional skills and cultural understanding. Human element is not only the key to the current predicaments, but also a contemporary interpretation of cultural communication.

The full review is currently available only in Chinese and can be downloaded on our website. For more information, please contact Managers of the Association.